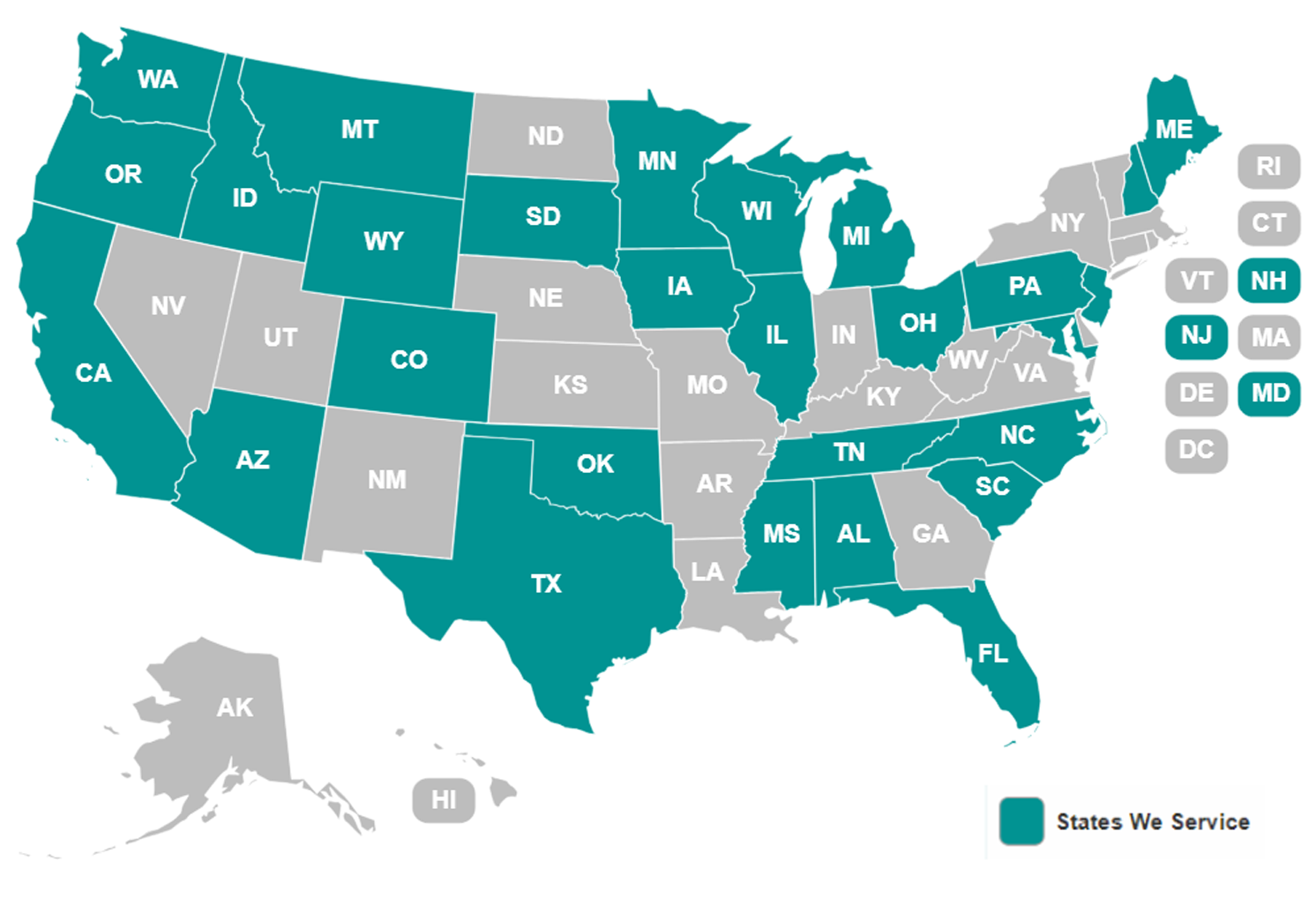

Our Service Locations

- Alabama Consumer Credit License- 2051202

- Arizona Broker License - 1049430

- Arizona Mortgage Banker License - P

- California DFPI Financing Law License – 60DBO-162052

Licensed by California Department of Financial Protection and Innovation. Loans made or arranged pursuant to under the California Financing Law License #60DBO-162052 - Colorado Mortgage Company Registration

- Florida Mortgage Lender License – MLD2369

- Illinois Residential Mortgage License – MB.6761684

Regulated by: IDFPR-Residential Mortgage Banking 555 W. Monroe, Suite 500 Chicago, IL 60661 (844)768-1713 - Idaho Mortgage Broker/Lender License - MBL-2082051202

- Iowa Mortgage Banker License – 2022-0192

- Maine Loan Broker License – 2051202

- Maryland Mortgage Lender License

- Michigan 1st Mortgage Broker/Lender License – FL0023280

- Michigan 2nd Mortgage Broker/Lender Registrant – SR0023281

- Minnesota Residential Mortgage Originator License – MN-MO-2051202

- Mississippi Mortgage Lender License - 2051202

- Montana Mortgage Lender License – 2051202

- North Carolina Mortgage Lender License- L-224595

- New Hampshire Mortgage Banker License – 27260-MB

- New Jersey Residential Mortgage Broker License

Licensed by the NJ Department of Banking and Insurance. Perry Johnson Mortgage Company, Inc. arranges loans with third-party providers; does not make any mortgage loan commitments or fund any mortgage loans. - Ohio Residential Mortgage Lending Act Certificate of Registration – RM.804804.000

- Oklahoma Mortgage Broker License – MB014513

- Oklahoma Mortgage Lender License - ML016871

- Oregon Mortgage Lending License – 2051202

- Pennsylvania Mortgage Lender License - 110721

- South Carolina-DCA Mortgage Broker License

- South Carolina-BFI Mortgage Lender / Servicer License - MLS - 2051202

- South Dakota Mortgage Lender License – 2051202

- Tennessee Mortgage License – 2051202

- Texas – SML Mortgage Company License

- Washington Consumer Loan Company License – CL-2051202

- Wisconsin Mortgage Banker License – 2051202BA

- Wyoming Mortgage Lender/Broker License – 4441

Visit the NMLS access page for more information- NMLS access page

Texas Disclaimer:

CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A COMPANY OR A RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV. A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550. THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV.

Illinois Disclaimer:

THE DEPARTMENT OF FINANCIAL AND PROFESSIONAL REGULATION (DEPARTMENT) EVALUATES OUR PERFORMANCE IN MEETING THE FINANCIAL SERVICES NEEDS OF THIS COMMUNITY, INCLUDING THE NEEDS OF LOW-INCOME TO MODERATE-INCOME HOUSEHOLDS. THE DEPARTMENT TAKES THIS EVALUATION INTO ACCOUNT WHEN DECIDING ON CERTAIN APPLICATIONS SUBMITTED BY US FOR APPROVAL BY THE DEPARTMENT. YOUR INVOLVEMENT IS ENCOURAGED. YOU MAY OBTAIN A COPY OF OUR EVALUATION. YOU MAY ALSO SUBMIT SIGNED, WRITTEN COMMENTS ABOUT OUR PERFORMANCE IN MEETING COMMUNITY FINANCIAL SERVICES NEEDS TO THE DEPARTMENT.